Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. As you mightve noticed tax rates are comparable to most other countries so the assumption that Thailand is a tax haven is untrue.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Note that if you work for a Thai company with an International Business Center IBC status have a tax-residency status in Thailand make a.

. On the First 5000. The existing standard rate for GST effective from 1 April 2015 is 6. Public Provident Fund can also be called a.

All forms of earnings are generally taxable and fall under the personal income tax bracket. Sub-central corporate income tax rates. Personal Income tax is payable on the taxable income of residents at the progressive.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Product Market Regulation 2018.

Malaysia follows a progressive tax rate from 0 to 28. E Pte Ltd is a non-resident company carrying out business in Malaysia. If your company is already GST-registered the MySST system will automatically register your company for SST.

The UK company will have to report the interest income in its annual tax return. Special rules apply to the taxation of capital gains from the sale of stock of closely held companies. Details of Public Revenue - Maldives.

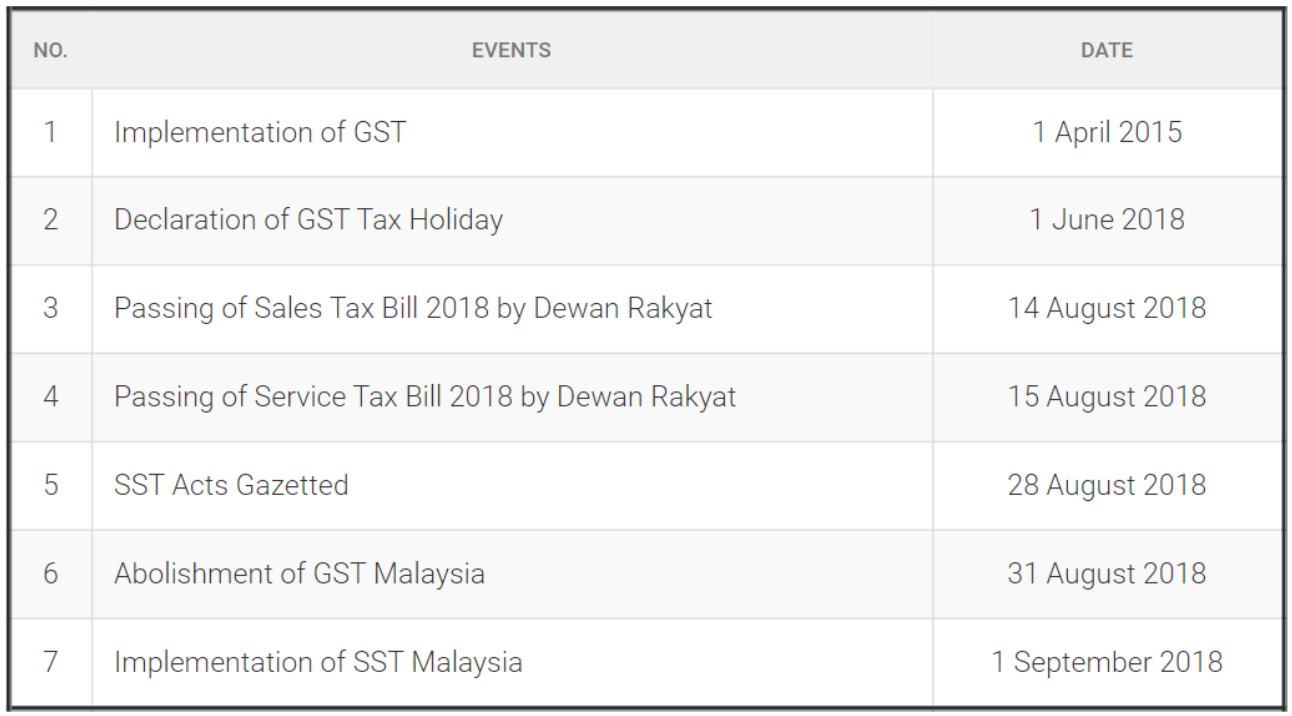

On the First 2500. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. SST in Malaysia was introduced to replace GST in 2018.

Calculations RM Rate TaxRM 0-2500. Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the. PPF was introduced in 1986 by the National Savings Institute of the Ministry of Finance to initiate savings in form of investment along with the benefit of return on it.

In order to determine the Malaysia income tax liability of an individual you need to first determine the tax residency and amount of chargeable income and then apply the progressive tax rate to it. Tax Rate of Company. Details of Public Revenue - Mongolia.

For advice on SST do not hesitate to contact Acclime. Targeted statutory corporate income tax rate. The Czech income tax rate for an individuals income in 2010 is a flat 15 rate.

Tax Rate FY 2018-19 AY 19-20. Public Provident Fund PPF is a government-initiated tax-saving investment option used by the citizens of India. Payer is carrying out business in Malaysia and charged interest against income derived from Malaysia.

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6. For non-quoted shares the tax rate is 25 since only 56 of the gain is taxable. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax.

Capital gains in the Czech Republic are taxed as income for companies and individuals. Government at a Glance. Government at a Glance - 2021 edition.

Not subject to withholding because branch and head office are not separate persons. Tax Rate FY 2019-20 AY 2020-21. The main source of personal income tax for expats in Thailand is through employment.

One saving grace is that Thailand does not have a 45 tax rate like some countries and in 2019 the 30 tax rate band was expanded so you can earn more at that rate before being put onto the 35 band. The same applies for losses on non-quoted shares ie. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

PPF Interest Rate 2022- All You Need to Know. Corporate tax in 2010 is 19. Up to 25 lakhs.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. If any foreign companyentity functioning in India receives income as royalty compensated by the Indian government against the agreement implemented with the Indian concern After 31st March 1961 and before 1St April 1976. Capital gains from the sale of shares by a company owning 10 or more is entitled to participation exemption under certain terms.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Regulation in Network and Service Sectors 2018.

Only 56 of the calculated loss can be deducted at 70. Key points of Malaysias income tax for individuals include.

2020 E Commerce Payments Trends Report Malaysia Country Insights

:max_bytes(150000):strip_icc()/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)

The Impact Of Exchange Rates On Japan S Economy

Global Distribution Of Revenue Loss From Corporate Tax Avoidance Re Estimation And Country Results Cobham 2018 Journal Of International Development Wiley Online Library

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Why It Matters In Paying Taxes Doing Business World Bank Group

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

Income Tax Malaysia 2018 Mypf My

10 Things To Know For Filing Income Tax In 2019 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Malaysia Sst Sales And Service Tax A Complete Guide

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

What You Need To Know About Payroll In Malaysia

How Much Does A Small Business Pay In Taxes

Individual Income Tax In Malaysia For Expatriates

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel